Becoming a trader is a dream shared by many who are captivated by the dynamic world of online trading. Mastering the art of trading stocks, CFDs, currency pairs, indices, or cryptocurrencies can be highly rewarding. It offers the potential to make profitable investments and earn money from the comfort of your home.

However, the journey to becoming a skilled and successful trader is not without its challenges. It requires thorough training, substantial experience, and a keen ability to conduct analyses and make accurate forecasts. Achieving professional-level success takes time; you cannot expect to become proficient or consistently profitable in just a few months. The path to becoming a successful online trader is paved with losses, risks, and numerous obstacles.

Nevertheless, many have succeeded in this endeavor. These independent traders have transformed their passion into a lucrative career. If you are ready to embrace the challenges and take calculated risks, this guide will walk you through the essential steps to become a trader. Let’s get started.

Emerging Trader Platforms

If you have arrived at this guide and already have the basic knowledge, you need to choose a good broker to become a trader. The broker is the intermediary between you and the market, allowing you to invest in the stock market independently and from home. They will also be the company responsible for storing your money and delivering it to you when you make a profit, so make sure they are reputable and trustworthy.

In this table you can see the top trading platforms in the industry. If you aspire to become a successful trader but are starting from scratch, leave the broker decision for now and proceed to the other sections of this guide.

Who is a trader and how they work

The meaning of trader is trader, i.e. a trader who exchanges (buys and sells) various financial instruments in order to make a profit.

The trader has quickly become one of the most advertised and coveted home-based jobs thanks to the spread of online brokers, which offer free access to the financial market allowing anyone (for better or worse) to invest their money in profitable, but also risky instruments.

Generally, a professional trader is a financial expert with a degree in economics or a deep knowledge of the subject, who studies market trends in order to place the right investments, earning money from his correct predictions.

The trader operates on various markets and using graphs, indicators and automatic systems to be able to margin (or contain the loss) at every variation, even the smallest on:

- stock market, where the buying and selling of shares and derivatives takes place;

- forex, the currency market;

- stock exchange indices, such as FTSE MIB, DAX, NASDAQ 100 etc.;

- commodities and cryptocurrencies, which are highly volatile instruments.

Professional traders work from home or in their own offices, either trading online on their own account or as a private consultant if they have a licence to do so.

All investors can be considered traders, from famous billionaires such as Warren Buffett (who have made a fortune from their investments) to the neighbour who trades online in his office. All you need, as mentioned, is a broker to trade on and a lot of training.

The professional trader bases his work on the success of daily or monthly financial investments. To earn money, therefore, a stock trader has to look at the market by making the right predictions, and everyone knows how stock exchanges, forex and cryptocurrencies can suddenly gain or lose value. After all, they incorporate the entire volume of world trade, traders’ feelings, governments’ choices, natural events and more.

How much does a trader earn?

A trader’s activity can be very well remunerated. A trader’s earnings derive directly from his or her ability to close a trade positively. Having said that, a trader who has large amounts of capital at his disposal has the possibility of being able to earn exponentially (when a trade goes right) compared to those traders (most) who have little money.

Ray Dalio is one of the richest traders in the world, his wealth is estimated at around $18.6 billion, money he made working as a professional trader at the highest level. Yet, when he started as a trader he was far from this figure.

How does one come to earn and accumulate so much?

A professional trader must above all be an expert in managing his capital (money management). It is good to know that not all trading operations have the same level of risk, so it is common practice for a trader to diversify his investments in the stock market.

Over the years, a self-respecting trader must necessarily acquire the right skills that allow him to be able to allocate his money in such a way as to grow exponentially by spreading the risks on multiple financial instruments.

Another necessary condition to earn and accumulate a lot with trading is a high and deep “preparation in the field” and a long practical experience. This is what we will talk about in the next paragraph.

Is trading safe?

All this makes the job of a trader highly challenging and risky. There are precise trading strategies that can be applied, but finance is not an exact science. The earnings of online traders are never certain, even for real experts.

Of course, some manage to limit their risks better than others and know how to earn a lot of money through online trading. It is possible to make a living from trading and there are many examples of people who have done so (even in Italy).

How to start as a trader

Starting out as an online trader is not complicated at all. You don’t need a degree to be a trader, a VAT number or any other bureaucracy, and that’s a good thing. Unfortunately, however, ease comes at a price: too many inexperienced people jump into risky online investments, lose their money or fall for big scams.

Steps to become a professional trader

- Training and Courses: While anyone can become a trader, 95% of traders do not make a profit. The reason? Little training and little knowledge of the markets. Studying, reading books on the subject, following specialist journals, or more simply learning how to read the balance sheet of a company can be useful for obtaining good results in the medium to long term;

- Choosing the right platform: Immediately after the theory comes the importance of using a suitable platform and a reliable broker. The web is full of scams and scam traders. Therefore, selecting the best platform to start trading can really limit the risk of getting little from your operations (due to high spreads applied by brokers that would nullify the positive results) or in the worst case scenario, to lose the entire capital invested;

- Use your head: FOMO (fear of missing out) for a trader is the fear of being left out of a stock market transaction. This compulsive worry is triggered in the trader when a share, an index or a currency suddenly gains (or loses) value during a stock market transaction. When confronted with the sudden volatility of a share price, novice traders risk rushing headlong (buying or selling), forgetting to implement the most basic rules to follow before placing a trade: objectively assessing the reasons for the fluctuation, checking for rumours and studying the fundamentals of the underlying asset.

- Setting goals and limits: “Never invest more than you are willing to lose”, this is a golden rule that applies to both a professional trader and a novice trader. In addition, understanding when it is appropriate to close a trade and be satisfied with the results obtained or close a losing trade to “limit the damage”, is one of the main skills that make the difference between losing traders and winning traders.

Books and courses for traders

If you want online trading to become your job, you don’t need a proper course of study. A master’s degree in finance or economics of the financial markets will help you acquire your licence as an advisor and guide others.

But if you want to be an independent trader, you don’t need a degree, but you do need to learn the “noble art of trading”.

What should you study to become a trader? Start with the best books on forex trading or stock trading, written by experts in finance and financial markets. Some are more theoretical, some tell the story of professional traders, and some reveal secrets and replicable strategies.

If you prefer, you can also download some free pdf ebooks to help you get to grips with the basics of online trading.

[php snippet=4]

There are also courses to become a trader, which are useful if you prefer a dynamic learning method with the use of practical videos and serious tutorials. Click below to find a trader course that we strongly recommend.

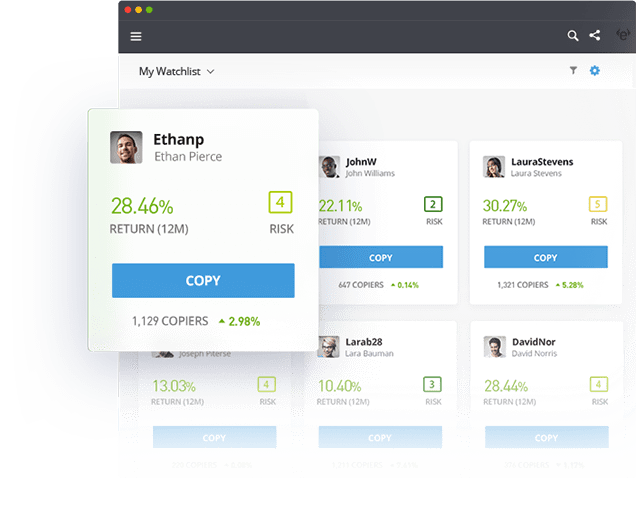

Copy Trading for beginners

A begginer trader needs to become familiar with the tools and know how the real professionals think and act. Using the demo account provided by high-end brokers is the first step to test the platform without risking losing a lot of money.

After testing and learning the theory from courses and books, the most gradual approach is to start with copy trading. This is a feature, only available with some brokers, that allows you to replicate the same moves as professional traders from around the world.

You can choose who to copy based on your goals and the trader’s risk level, and the platform will automatically follow the activities of the chosen investor. The best broker for copy trading is eToro: try how it works.

Platforms for Professional Traders

In order to start trading assets (cryptocurrencies, CFDs, stocks, gold, silver, oil, currencies, etc.) the trader must open a trading account with an authorised broker, making sure to choose the most established, secure and well reviewed ones in the market.

The broker is responsible for managing the deposit, paying the trader and providing other valuable services through trading platforms, software or websites with which to interact in the market.

Some brokers work only on proprietary software, while others allow the use of open source platforms that are popular for their customisation, charts and technical analysis indicators. The most widely used online trading platforms are:

- MetaTrader 4: downloadable platform to be associated with a trading account;

- Native WebTrader or Mobile App: browser or smartphone platforms offered by a broker to its clients;

- TradingView: excellent web platform where it is possible to make analysis and view graphs and histories of an asset.

Webtrader platform

Novice traders who use the Webtrader Platform offered by a broker (AvaTrade, Plus500 or eToro) prefer it to more complex platforms and tools such as MT4.

Those who trade with a webtrader platform have access to market information from any device (including mobile) that has an internet connection and a web browser.

Typically, these browser-based platforms allow any financial trader, novice or expert, complete control over strategic decisions to buy or sell an asset and total access to the stock and forex markets 24 hours a day.

The key features that can usually be found in most web traders are:

- Analyses and Tables: allowing each trader to have access to real-time statistics showing detailed information on all open and closed trades in a visual way. Thanks to this relevant information, investors can view various statistics in different time frames.

- Trend Viewer: a powerful visual tool that allows online traders to interpret all currency market conditions and other major market trends.

- Trading Cubes: a means of speeding up trading operations with the ability to view lot sizes, prices and preferred assets in order to trade as quickly as possible.

- Demo Platform: This is a limited-life option as it can only be used for a fortnight from the moment the trader opens the demo account.

By using a Webtrader platform, customers can benefit from a good software with its detailed interface even if the trading information (charts, history etc.) is not always complete and detailed.

Among the features most appreciated by traders there is above all the ease of use, the possibility to benefit from a set of advanced functionalities and to open and close their positions in a few fractions of a second (speed of execution and functionality vary according to the chosen broker).

MetaTrader 4 platform

Many experienced traders choose to use the MT4 Platform for their trading operations. This powerful software has become popular for being user-friendly and facilitating asset trading with a full suite of charts and analysis.

The MT4 Platform can be used by any trader (although it is more suitable for experienced traders) and offers powerful tools such as:

- manage and position their trades;

- possibility of analysing prices;

- insert scripts to automate trades;

- technical analysis using advanced tools;

- make the best use of the most sophisticated trading techniques.

Thanks to the Indicators and Tabulation Tools section, every online trader has the possibility to view all the most popular indicators and tabulation tools to make their analysis quite accurate and fast.

Custom indicators can be loaded allowing investors to trade automatically.

MT4 is very popular and provides a fast and functionally advanced tool.

Even for traders who practice scalping and need immediate data and execution, the MT4 Platform is the ideal solution and package for charting.

Innovative interface and simple order routing are the most appreciated features: traders have the possibility to open and close trades even those outside the table.

In addition, all the data that is used to make decisions is included in the intuitive and easy-to-use interface, which is also suitable for newbies.

You can use the MetaTrader 4 platform by opening an account at:

- AvaTrade

- Markets.com

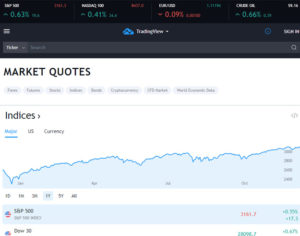

Tradingview

Tradingview is the platform of the moment and is attracting the attention of many traders around the world. It has all the charts and indicators you need to monitor the markets and can be linked to the accounts of several brokers.

In addition, it offers various scripts that can be installed on the most common platforms, to add other automatic indicators or robots to support you in closing/opening positions in case market conditions change inadvertently.

Many professional traders have already chosen it and exchange their information within it, in turn drawing on the community that has been created, sharing strategies and ideas.

Mobile App: mobile trading at the click of a button

Thanks to the platforms that can be downloaded directly from the App Store and Google Play, mobile trading directly from your electronic devices (smartphones, tablets, etc.) has never been easier and faster.

If you are a “mobile” trader who likes to travel from home, you can manage your accounts directly from your Android or iPhone, monitor your investments and trade assets wherever you are.

The trading apps are designed to be compatible with all common mobile devices and are developed in a very user friendly format for fast, safe and smart trading.

Famous traders

Professional traders do exist, proof that commitment and preparation can open up profitable opportunities in this field too. It is a long and risky path, which requires a lot of training, time and experience, but it is possible.

Who are the famous traders in the world? Steven Cohen founded SAC Capital Advisors, a leading hedge fund focused primarily on trading equities and David Tepper the founder of the wildly successful hedge fund Appaloosa Management. Tepper is a specialist in distressed debt investing.

If we broaden the field not only to online traders but also to international investors, Warren Buffett and George Soros are prominent figures in world finance who became billionaires by trading financial securities.

Who knows, one day your name may be among these famous professional traders.

Disclaimer trying to become an independent trader could expose your capital to risk. The following article is intended for informational purposes only and is not an invitation to invest or to become an online trader.

Becoming a trader – Useful questions

Yes. To become an expert trader you don’t need a specific degree, you can become a professional just by earning money. However, training is indispensable in any case: results can only be achieved with a thorough knowledge of the markets.

Amazon trader is just a way of referring to investors who like to trade Amazon securities and CFDs (AMZN). It is not really a specialisation: anyone can open a trading account and start buying and selling Amazon assets.

An electricity trader is an investor who speculates on the volatility of the price of electricity by buying and selling derivatives on the Power Exchange.

Yes. Some platforms allow you to open a trading account with a minimum deposit of 100 euros. Of course, the larger the amount invested, the greater the potential profits..

Being a professional trader does not require any particular course of study. Obviously, however, it is necessary to know the rules of the market and a good familiarity with technical analysis. Therefore, it is recommended to read several books or attend trading courses before calling yourself an expert in the field.