- Free demo account €100,000

- Stock broker, Crypto Exchange and Deposit Account

- Buy real Bitcoin and Cryptocurrencies

- Copy Top Traders with one click

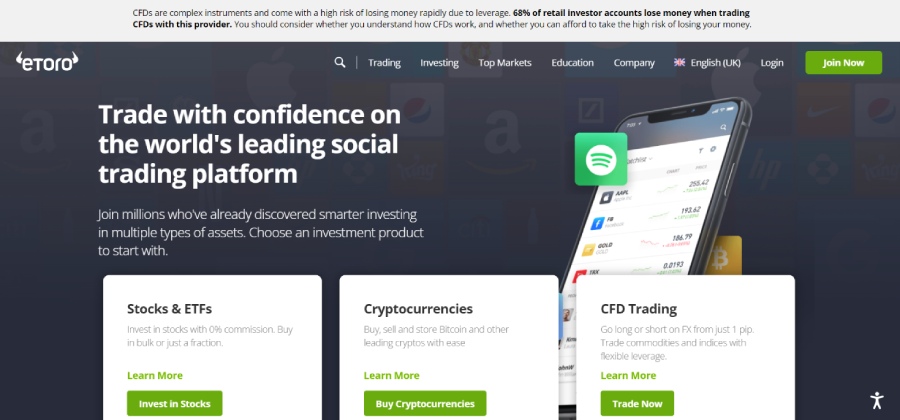

eToro is renowned globally as one of the top platforms for investing in stocks and cryptocurrencies. Its standout feature, social trading, revolutionizes investing by enabling beginners to replicate the trades of the world’s top investors with just a click. Users can buy shares with zero commission, as well as trade in cryptocurrencies, ETFs, and more.

eToro offers more than just CFD trading. You can purchase real shares, cryptocurrencies, and ETFs. The platform also allows you to invest in asset portfolios—known as Social Trading—where an artificial intelligence acts as a robo-advisor to manage your investments.

Despite some negative feedback, eToro’s long-standing history, regulatory compliance, and a robust, well-functioning platform highlight its reliability and value. Dive deeper into what makes eToro a preferred choice in our comprehensive review.

What is eToro?

eToro is an international investment platform that offers multi-asset trading to individuals worldwide. Founded in January 2007 in Tel Aviv by brothers Yoni and Ronen Assia, eToro Ltd has grown significantly over the years.

Today, with its headquarters in Limassol, Cyprus, eToro operates globally and boasts over 20 million registered users, including both verified and non-verified accounts. It has become one of the most well-known investment companies, particularly popular among home investors new to online trading.

Below is a table providing key information about the broker eToro.

| Year of foundation | 2007 |

| Official website | www.etoro.com |

| CEO | Yoni Assia |

| Regulations | CySEC (n. 109/10), FCA (FRN 583263), ASIC (n. 491139) |

| eToro minimum deposit | $50 |

| Demo Trading Account | Yes, free |

| Customer care | email, chat, web app |

| Trustpilot Reviews | 2,5/5 |

| Risk disclosure | 51% of retail investor accounts lose money when trading CFDs with this provider. |

eToro: Pros and Cons

What we Like

0% commission on Real Stocks

Exchange for crypto

Copyportfolio for investors

Online Trading Academy

What we Don’t Like

- Only US Dollar account

- High spread on some assets

Is eToro a Scam?

The first thing many users ask themselves is whether eToro is a scam or not. Negative forum reviews and frequent incidents of financial fraud alarm those who are considering an online platform, even with established brokers.

eToro is regulated by various supervisory authorities, which oversee the operation of all trading platforms. In Europe, eToro is regulated by CySEC, the Cyprus Financial Markets Authority, and operates under the MiFID 2 regulations set by ESMA.

In the UK the FCA authorizes eToro, while in Australia eToro AUS is registered with ASIC.

As of 2021, eToro has also expressed its intention to go public via SPAC, merging with FinTech Acquisition Corp. V (NASDAQ: FTCV).

The broker is a partner of several English football clubs like Crystal Palace, Everton, Leicester City and Southampton, and European teams like Wolfsburg or Monaco.

The website is also one of the clearest and most comprehensive in terms of information, from company policy to key figures, from mission statement to risk warnings. It also has a strong social media presence, all details that a fraudulent or untrustworthy broker would omit to remain anonymous.

How to trade with eToro

With eToro everyone can start trading with simple steps. Here you can find hundreds of assets to invest in, both as CFDs and as underlying assets.

The user can buy or sell stocks, commodities, ETFs and cryptocurrencies, but also indices and currencies. eToro offers traders hundreds of assets to invest in, both as CFDs and as underlying assets.

There is a good choice of both stock and forex markets. Whether you want to buy shares in the short or long term, you can choose to trade with the underlying asset or with CFDs.

In the first case you buy shares at zero commission and also enjoy dividend payments. In the latter case, you can also consider shorting the stock or use higher leverage.

On equities and ETFs you can buy underlying assets, i.e. hold that stock in your own name, while also enjoying dividend payments (clearly without leverage and without being able to buy shorts).

You can also buy cryptocurrencies and hold them in the eToro Wallet. The broker has a wide choice of cyptos, from major currencies such as Bitcoin, Ethereum or Ripple to emerging altcoins, making a total of 16 cryptocurrencies.

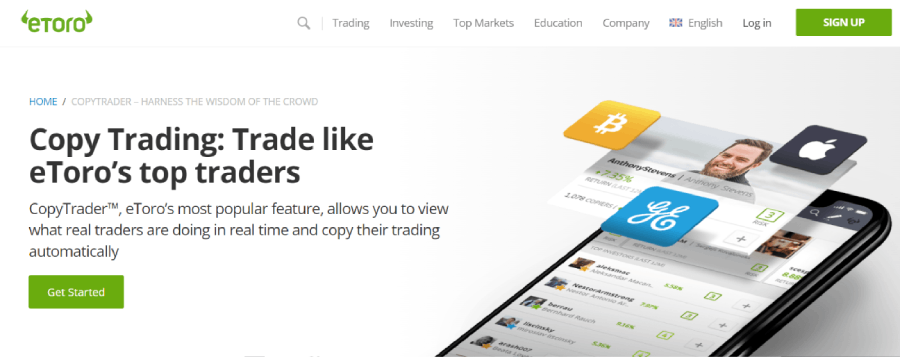

Social Trading

eToro stands out as the premier social trading platform globally. The platform features a dedicated section for the exchange of information, where users can share posts and news just like on a social network.

This unique setup allows you to invest in the stock market within a community of traders, enhancing your knowledge and providing access to shared information, which can help you make more informed investment decisions.

However, the cornerstone of eToro’s offerings is its renowned copy trading feature. This allows you to automatically replicate the financial operations of an experienced trader, known as a popular investor, simplifying the process of learning and executing successful trades.

This makes trading on eToro accessible even to beginners, who by copying the market operations of advanced traders can enjoy the same gains (or losses).

You can choose the popular investor to copy from all over the world, filtering by country, number of followers, percentage of profit and degree of risk, adapting it to your trader profile.

Smart Portfolio

eToro has taken social trading to the next level with an innovative investment product called Smart Portfolio (formerly known as CopyPortfolio). This feature allows investors to buy bundles of thematic assets or invest in the results of several top traders in one go.

Types of Smart Portfolio on eToro:

- Top Investor Smart Portfolio: This includes a collection of traders who are frequently copied.

- Themed Market Smart Portfolio: Curated by eToro experts, popular investors, or major global institutions, this portfolio consists of a mix of CFDs, commodities, stocks, ETFs, and actual cryptocurrencies.

- Partner Smart Portfolio: Collaboratively created with various institutional partners to offer specialized investment strategies.

Investors can explore different types of packages on the ‘Discover’ page, selecting the one most promising and suitable for their strategy. The minimum investment required to participate in a Smart Portfolio is $1,000, and it is commission-free.

Diversification and Strategy:

Smart Portfolios are carefully curated collections that follow a specific theme or investment strategy. By investing in a Smart Portfolio, you can instantly diversify your holdings across a range of assets and traders with just one click.

Dynamic Rebalancing:

Smart Portfolios are periodically reassessed to maximize the thematic investment strategy they are based on. Each person or asset included in a Smart Portfolio is treated as a single investment. Investments are proportionally opened in the same percentage amount of your allocated funds, mirroring the process of copying another investor.

eToro Trading Platform

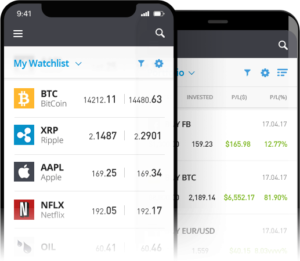

In addition to the various assets, the social trading and its success, the straightforwardness and clarity of the platform is also striking about eToro. The broker does not have downloadable desktop software, but has a web app and a downloadable mobile app on iOS and Android.

The clean design and usability are really appealing, although for some it can be limiting not to use the eToro account on other trading platforms (e.g. MetaTrader 4).

There is a lot of functionality, although it is not possible to customise the screen too much. From the homepage (Favorites List) you can place orders in seconds, following the trend and sentiment of other traders.

In the Portfolio you access the overview of your investments to monitor or manage them.

In the Search section, the user can position themselves on People and identify the top traders to follow, to automate their activity even if they are beginners. Once identified, simply click on the trader’s profile to view details or click on Copy.

Selecting CopyPortfolios, on the other hand, provides access to the purchase of managed portfolios.

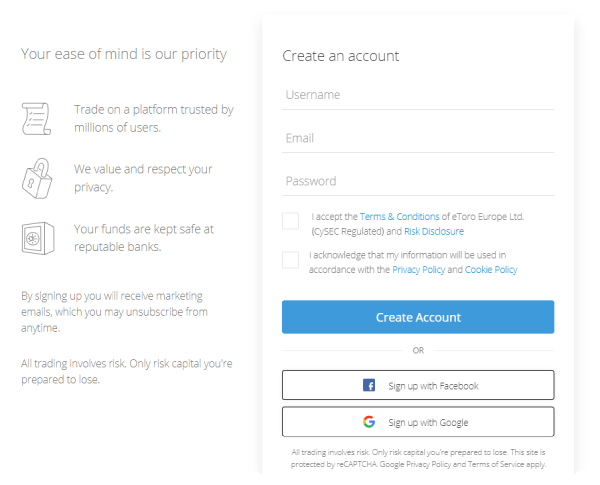

How to start investing with eToro

If you would like to take a closer look at eToro, you can create a free account and get inside the trading platform.

1. Open a free account

The procedure does not require any real registration: just access the official eToro website via this link and click on the Join Now button.

Remember that your capital is at risk, so be careful and invest your money carefully.

At this point you will be asked to login:

- username;

- email;

- Password of your choice

You can also login to eToro via your Facebook profile or Google account.

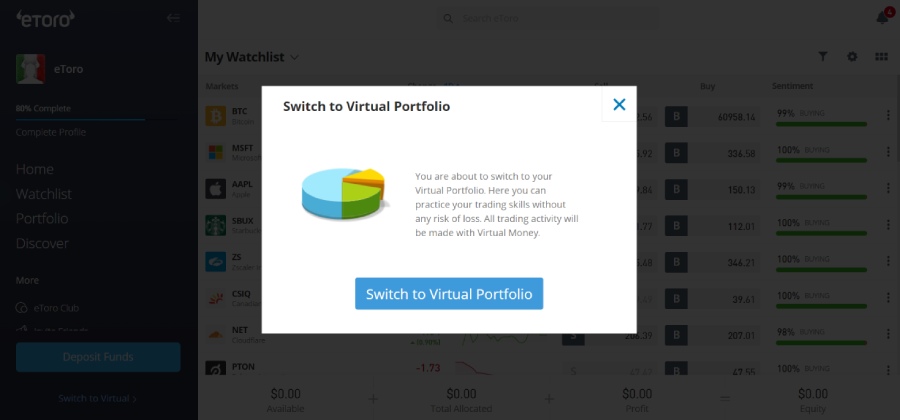

2. Switch to free demo trading account

When registering, you can decide whether you want to use the real account or try the platform first with the free demo account. This is highly recommended, especially for beginner traders, as opening a demo account allows you to get familiar with the strategies without losing money.

eToro offers a trial account with 100,000 euros and full functionality, which can be recharged on demand if you run out of money. The use of the demo trading account is unlimited, so you can use it as long as you like.

The $100,000 fund will also be automatically replenished once it is depleted.

How to Buy Stocks with eToro

After logging in to the eToro trading platform, you can choose the shares you like the most from the “Stocks” section, with over 1,000 stocks. Here you can find the most traded European, American and Asian companies.

Now we can opt for a double option:

- Buy the shares in “Real Stocks”, with the actual purchase of the Asset. Simply remove the leverage and select the amount to buy. In this way we become full shareholders of the company and also participate in the eventual distribution of dividends.

- Trade CFD contracts. To do this, simply activate the financial leverage (maximum 1:5) and choose between long and short CFDs, speculating on both the rise and fall of the share price.

This dual offering makes eToro perfect for any type of investor. All with no fixed commissions and no management fees.

How to Buy Bitcoin and Crytptos with eToro

One of the biggest advantages offered by eToro is that it is a stock broker and a cryptocurrency exchange at the same time. The trading platform allows you to:

- buy and hold real cryptocurrency, for hodl investors looking for a long-term investment.

At eToro you can buy Bitcoin and decide at any time whether to sell it and move your cryptocurrency to an online wallet.

You have three options with eToro, an advantage that few online trading brokers offer.

You can also buy and sell Ethereum, Dogecoin, Polkadot, Chainlink, Ripple, Litecoin, Dash and many other cryptocurrencies (the list is updated periodically).

The fees vary depending on the cryptocurrency you choose to trade at eToro. Go to the website for more information.

Minimum Deposit on eToro

The minimum deposit required by eToro is $100. The capital is used to ensure a minimum liquidity to carry out the operations, and you can also use it in full.

Once registered, to start trading on eToro you need to make the first deposit. To deposit at eToro you only need to:

- Login to your account;

- Select Deposit Funds;

- Enter the amount to be deposited and the currency;

- Select your payment method.

eToro accepts debit cards, Skrill, bank transfers depending on the country. The transfer is valid in any country: it takes 3 to 5 working days to see the amount credited to your eToro account.

In order to pay by bank transfer on eToro, you will need to print the details that appear on the screen, after having done the steps listed above. After that, you will need to submit your request to the bank, which will complete a SWIFT document. The document should then be uploaded as a scanned copy (or screenshot if you choose to pay from home banking).

For the first deposit eToro requires a minimum deposit ranging from $50 to $10,000. When registering a corporate account the minimum initial deposit is $10,000. However, if the account has not yet been verified (by sending the documents) eToro sets a maximum deposit of $ 2,250.

All other subsequent deposits must be at least $50, while by wire transfer the minimum amount is $500.

Withdrawals on eToro

To withdraw money from eToro you must select the item Withdraw Funds in the menu, enter the amount to be withdrawn in dollars and fill out an electronic withdrawal form authorizing the operation.

The broker will only allow withdrawals if your account has been verified and for amounts over $100. eToro will pay you more or less immediately depending on the withdrawal method you choose:

- Debit card: up to 8 business days;

- Bank transfer: up to 8 business days;

- Neteller: 1-2 business days;

- Skrill: 1-2 working days;

- WebMoney: 1-2 working days;

- China Union Pay: 1-2 working days.

eToro Commissions

On the withdrawal eToro applies a fixed fee of $ 5 plus a spread on exchange rates, since you can only request the amount in dollars. Recently the broker has lowered the dry fee on withdrawals (previously it was $25), making it much more profitable.

eToro also charges commissions on deposits (0.5%), but does not charge anything on account management or trading operations (apart from the spread), which is particularly advantageous for those who buy cryptocurrency, ETFs and real stocks, without leverage and in a long position.

Let’s see in detail:

| Assets | Commissions |

| Real Stocks | 0% commissions |

| CFDs (stocks, crypto, ETFs, ..) | 0,09% + overnight (6,4% long, 2,9% short) |

| ETFs | 0,09% no leverage |

| Crypto | 0,75% to 5% variables (BTC 0,75%) |

| Indices | 0,04% to 1,2% variables |

| Commodities | 0,02% to 1,2% variables |

| Forex | 0,01% to 0,5% variables (EUR/USD 0,03%) |

Conversion fees, to be honest, are variable and may seem unclear especially to the untrained eye. In any case, everything is documented on the costs page, which you should read carefully.

The broker applies a Pips50 (0.50%) as a conversion fee when depositing by bank transfer and a variable pip as a conversion fee when depositing or withdrawing by other methods.

Finally, in case of inactivity, eToro charges a $10 fee if the trader’s account remains dormant for more than 12 consecutive months.

eToro Customer Support

eToro’s customer support is a little more spotty than other brokers. There is no telephone support and the live chat reserved for members is difficult to find according to the opinion of users.

That said, support is present and available in several languages. You can rely on them if you need help with your trading account.

To answer the most frequently asked questions, the site refers to the resources inside, which are very thorough but sometimes not able to clarify every doubt as a human intervention.

However, it is possible to open a ticket by entering your email address and waiting for the operator to reply.

eToro Trading Mobile

If you want to monitor your investments wherever you are, eToro has also come up with a free and smooth mobile app.

For a simple and user-friendly trading experience away from home, traders can download the eToro app for smartphones and tablets. The app is free and available in Uk for iOS (iPhone and iPad) or Android.

It allows you to set up notifications about your open positions or trading hours, to keep you updated in real time on the latest market updates.

Alternative a eToro

eToro è una delle più valide piattaforme di trading online sia per investitori entry level che esperti, ma non l’unica. Ecco le migliori alternative al broker eToro, con i pro e contro a confronto.

eToro vs Plus500

Plus500 is a fierce alternative to eToro due to its low commissions and usability. The world-renowned broker, also born in Israel, is targeting a different segment of investors from eToro, perhaps a little more experienced. Its platform, as native as eToro’s, is in fact slightly more technical (but less attractive in design).

Otherwise, both Plus500 and eToro have their own mobile app, allow you to open a free demo account, trade ETFs, stocks, forex and cryptocurrencies.

Plus500 doesn’t allow copytrading, but has better customer service than eToro.

eToro vs Moneyfarm

Let’s be clear: Moneyfarm and eToro are two different services. The first platform is a robo advisor, an artificial intelligence that builds a portfolio of ETFs based on your needs. It’s not an online trading broker, so you won’t be able to buy individual stocks, let alone cryptocurrencies.

The comparison between eToro and Moneyfarm is mainly about the issue of automated investing, what the eToro broker calls CopyPortfolio.

Moneyfarm is not an online trading platform, thanks to a robo advisor, identifies the user and creates a portfolio of ETFs balanced according to their degree of risk. With eToro, it is the trader who decides which of the portfolios to copy, as well as being able to choose to buy the Top Trader CopyPortfolios package (generated by the activity of popular investors).

The minimum threshold to invest is almost the same: 5,000 euros on Moneyfarm and 5,000 dollars on eToro. Moneyfarm applies commissions (even low ones), while eToro does not apply commissions (except for spreads). Also, unlike Moneyfarm, it offers more diversified packages, including pure stocks as well as ETFs.

The advantage of Moneyfarm (review), however, is that it provides a dedicated advisor for its investors, which eToro does less on a bespoke basis.

eToro Opinions

On forums such as Yahoo some people are pointing the finger at the broker claiming that eToro is a scam. We have already shown that the broker is regulated by several supervisory authorities, has been active since 2007 and has a very large community of subscribers. eToro has excellent positive reviews, pays its traders regularly and has a precise headquarters and working group. It’s all out in the open, and there are no indications that it’s a scam broker.

However, to tell the truth, the opinions on eToro that can be found online are not exactly flattering. Many complain about high commissions, especially on withdrawals and commission rates. Many, however, praise the simplicity of the platform and the copy-trading, which is easy to use and potentially profitable.

Despite a less than impeccable customer service and some hefty commissions, eToro is one of the best brokers around. Copy-trading, BTC and crypto wallet and exchange, education, demo account, buying stocks, ETFs and CopyPortfolio: there is really everything you can expect from a broker (and more), perfect for beginners and also suitable for experienced investors (although some would prefer a more technical platform to the clean design). Signing up for free and testing the operation is definitely worth it, it’s safe and can be the first step into the world of forex and trading.

eToro of the best trading platform to start investing in stocks, cryptocurrencies and other assets. You should try copy trading with a free demo account. One of the broker you can trust.

eToro is a multi-asset platform that offers both investment in shares and cryptoassets as well as CFD trading.

Please be aware that CFDs are complex instruments with a high risk of rapidly losing money due to leverage. 51% of retail investor accounts experience losses when trading CFDs with this provider. You should carefully consider if you fully understand how CFDs work and if you can bear the high risk of losing your funds.

This information is for educational and informational purposes only and should not be considered investment advice or a recommendation. Past performance does not guarantee future results.

Copy Trading does not constitute investment advice. The value of your investments can fluctuate, and your capital is at risk.

Cryptoasset investments are highly volatile and unregulated in some EU countries. No consumer protections are in place, and profits may be subject to taxation.

eToro USA LLC does not offer CFDs, makes no representations, and assumes no liability for the accuracy or completeness of this publication’s content, which was prepared by our partner using publicly available, non-entity-specific information about eToro.

FAQs about eToro

eToro pursues a policy of transparency in terms of company information and conditions. Although on some forums many opinions claim that eToro is a scam, the company is regulated by FCA and has always demonstrated impeccable conduct. It is important to distinguish a scam broker from a broker with some flaws (e.g. high commissions).

You can trade stocks, cryptos and a variety of financial instruments, copy successful traders and profit from their successful moves, or invest in CopyPortfolios to buy packages of shares and ETFs. However, remember that online trading also involves many risks of losing your capital.

Yes, on stocks, ETFs and indices eToro pays (or debits) dividends on the ex-dividend day. An investor in a buy position will receive 70% of the gross dividend for US-listed shares and 85% for other shares. If the investor is in a sell position, he will lose 100% of the gross coupon.