Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a financial advisor before making investment decisions.

Investors heading into 2025 face a dynamic market landscape shaped by high interest rates, cooling inflation, and shifting global growth trends. According to financial experts and analysts, some asset classes are poised to shine this year. From rock-solid high-yield savings to surging stocks and commodities, the best investments of 2025 balance opportunity and risk. In this report, we’ll explore seven of the top investment options – each backed by expert insights on why it’s attractive now, what returns to expect, the risks involved, and who it’s best suited for.

Whether you’re seeking stability or growth, short-term income or long-term appreciation, these seven investments cover the spectrum. Let’s dive into the list of expert-recommended investments for 2025 and see how they stack up in terms of risk and return.

Summary Table: The 7 Best Investments for 2025

| Investment | Risk Level | Expected Return (2025) | Investor Profile |

|---|---|---|---|

| High-Yield Savings | Very Low | 4–5% | Conservative, Short-term |

| Government Bonds | Low | 4–7% | Income-focused, Conservative |

| Corporate Bonds | Medium | 6–10% | Income-seeking, Moderate risk |

| U.S. Stocks (Large-Cap) | High | ~10% | Growth-oriented, Long-term |

| International/EM Stocks | High | 10–15% | Diversification, Long-term |

| Real Estate (REITs) | Medium | 8–12% | Income & Growth, Diversification |

| Gold & Precious Metals | Medium | 5–10% | Risk Hedge, Diversification |

1. Cash and Cash Equivalents (High-Yield Savings & Money Market)

Even though a high-yield savings account or money market fund isn’t a traditional “investment” in the market, experts are placing cash in the spotlight for 2025. After a decade of near-zero interest rates, cash yields are now at multi-year highs, offering a risk-free return around 4–5%. This makes parking money in high-yield accounts an attractive option – especially for short-term goals or as a buffer against market volatility.

Why it’s attractive now: Online savings accounts and money market funds are currently paying interest rates that haven’t been seen in years. Even after some modest rate cuts by central banks, yields remain elevated heading into 2025. This means investors can earn a solid return on cash holdings with virtually zero risk. In fact, many brokerage sweep accounts and money market funds offer rates comparable to dedicated savings accounts, allowing you to earn ~4-5% APY on idle cash.

Risk and return profile: Cash equivalents are as safe as it gets – backed by bank guarantees or government securities in the case of money market funds. There’s no fluctuation in principal, and your return is the fixed interest earned. The trade-off for this safety is a lower return than riskier investments. However, in 2025’s environment, a ~5% risk-free return actually outpaces inflation (which is trending near 3%), preserving and mildly growing purchasing power. As one financial planner puts it, having a cash cushion “offers a ballast to a portfolio,” helping investors sleep at night during stock market swings.

Historical performance: Historically, cash yields have been low (near 0–1% for much of the 2010s). That changed in 2023–2024 as central banks hiked rates to fight inflation. Now, yields around 4–5% on high-yield savings are the norm – the highest cash returns in over 15 years. While cash won’t provide capital gains, earning 5% with zero volatility is a very competitive return in a year when some other assets might be choppy.

Who it’s best suited for: This category is ideal for conservative investors or those with short-term needs. If you have money set aside for an emergency fund, a near-term purchase (like a home down payment), or you simply can’t stomach market risk right now, high-yield cash is a smart choice. It’s also a place to park funds while waiting for the right investment opportunity – you’ll earn interest in the meantime. Even more aggressive investors may keep a portion in cash for liquidity and safety.

- Risk: Very Low – Federally insured (for bank accounts) or backed by high-quality short-term assets; virtually no chance of loss of principal.

- Return Potential: Low (but stable) – ~4–5% annual yield in 2025, fixed interest. Little to no growth beyond the interest rate.

- Best For: Short-term savers, emergency funds, and as a safe haven for risk-averse investors. Time horizon of 0–3 years or as a liquid reserve in your portfolio.

2. Government Bonds (Treasuries and Investment-Grade Bonds)

Government bonds – particularly U.S. Treasury bonds – are a perennial favorite for conservative investors. In 2025, they’re drawing fresh attention because yields are the highest in years, translating to both attractive income and potential price gains if interest rates fall. A government bond is essentially a loan to a government in exchange for regular interest payments (coupon) and repayment at maturity. U.S. Treasuries are considered virtually risk-free, backed by the full faith and credit of the government.

Why it’s attractive now: After a rough patch in 2022–2023 (when rising rates hurt bond prices), government bonds are “back” in favor. Yields on benchmark bonds like the 10-year U.S. Treasury hovered around multi-decade highs in late 2024, reaching ~4.5–5%, the highest level since 2007. Such yields provide robust income to bond investors in 2025. Morgan Stanley notes that if U.S. Treasury yields simply stay in the 4–5% range in 2025, it would mark a strong turnaround for bonds after the mediocre returns of recent years. In other words, just holding bonds for their interest could deliver mid-single-digit returns, and any decline in yields (rate cuts) would push bond prices up, adding capital gains on top.

Importantly, economists expect that central banks have ended their rate hikes and are beginning to ease monetary policy as inflation cools. The U.S. Federal Reserve, for instance, is projected to cut rates gradually through 2025. For bond investors, rate cuts typically boost bond prices (since newer bonds will offer lower yields, making existing higher-yield bonds more valuable). Goldman Sachs analysts anticipate central bank easing could create a favorable backdrop for bonds, calling the current environment a potential “golden age” of bond investing for income. The combination of high starting yields + possible price appreciation gives government bonds a compelling case this year.

Risk and return profile: Government bonds are low-risk in terms of default (especially U.S. Treasuries or bonds from stable developed countries). The main risk is interest rate risk – bond prices fall when market interest rates rise. However, with rates near a peak, that risk is diminishing. In 2025, the focus is on earning the steady coupon income and perhaps benefitting from price gains if yields decline. A portfolio of 100% bonds will be much less volatile than stocks, though still subject to modest fluctuations (as we saw in recent years). For example, early 2025 did see some bond price swings as markets reacted to economic data, but bonds generally stabilize portfolios. As CFP Delia Fernandez explains, “Bonds offer a ballast to a portfolio, usually going up when stocks go down,” helping investors stay the course without panic selling.

In terms of return, current yields suggest government bond returns of ~4% or more for the year (the yield you lock in). If the Fed cuts rates more than expected, bond prices could rise, boosting total returns into the mid-to-high single digits. For instance, JPMorgan’s strategists note that a stabilization of the 10-year yield around 4% (down from ~4.5–5%) would turn 2025 into a much better year for bonds than 2024 was. Even in a flat rate scenario, investors collect the coupon, which is a solid low-risk return.

Historical and projected performance: The past two years were unusual, with 2022 delivering double-digit losses for bonds and 2023 roughly flat – because yields jumped dramatically from near 1% to over 4%. Now that yields are higher, the income from bonds is meaningful. For perspective, the U.S. Aggregate Bond Index returned just ~1–3% in 2024, but that included the tail end of rate hikes. With the cycle turning, many experts foresee bonds reverting to their role as steady gainers. Morgan Stanley expects 2025 to potentially be “the Year of the Bond,” as stability returns to fixed income markets and investors enjoy high income streams. If the economy hits a snag or stock volatility rises, government bonds could even outperform with flight-to-quality demand.

Who it’s best suited for: Government bonds suit conservative and income-focused investors, such as retirees or those nearing retirement who want to preserve capital but earn more than cash. They are also useful for diversification – even growth-oriented portfolios often include some bonds to cushion stock volatility. For an intermediate-term goal (3–5+ years), bonds can be a fit, offering higher certainty of return than stocks. Essentially, if you seek steady, predictable income with low default risk in 2025, Treasury and high-grade municipal bonds are prime candidates. Just remember that a longer time horizon (5+ years) is advisable to ride out any interest rate moves; shorter-term Treasury bills or notes can be used if your horizon is 1–3 years.

- Risk: Low – Virtually no default risk (especially with U.S. Treasuries). Moderate interest rate risk (prices fluctuate with rate changes, but 2025 outlook for rates is stable to falling).

- Return Potential: Low to Moderate – Currently ~4% yield on 10-year Treasuries; total return could reach ~5–7% if yields decline (bond prices rise). Provides fixed income stream.

- Best For: Income-oriented investors, those seeking stability or nearing retirement. Also suitable as the low-risk portion of a diversified portfolio. Time horizon of 3+ years recommended (to ensure you can hold to maturity or until prices recover from any interim dips).

3. Corporate Bonds (Investment-Grade and High-Yield Debt)

For slightly higher income, corporate bonds are on experts’ radars in 2025. Corporate bonds are issued by companies to finance operations or expansion, and they typically pay more interest than government bonds to compensate for higher risk. This category spans investment-grade bonds (issued by financially strong companies) and high-yield “junk” bonds (from less creditworthy issuers). Yields in the corporate bond market have risen significantly, making them appealing for investors willing to take on a bit more risk in exchange for extra return.

Why it’s attractive now: Simply put, corporate bond yields are high. At the end of 2024, average yields on investment-grade U.S. corporate bonds were around 5–6%, while high-yield bonds yielded about 7–8% or more. These are levels not seen since the aftermath of the 2008 financial crisis. For investors, this means you can earn equity-like returns (high single digits) from bond interest payments alone. As one analysis noted, the average U.S. high-yield bond started 2024 yielding ~8.5%, and though spreads have narrowed a bit, high-yield still offers a sizable income premium.

In 2025, with economic growth solid (but not too hot), many companies are in a good position to meet their debt obligations. Default rates on corporate bonds remain relatively low, according to credit rating agencies, albeit slightly up from ultra-low levels. This backdrop of healthy corporate finances + elevated yields creates an opportunity. Investors like BlackRock’s strategists suggest focusing on quality credit for income, calling the current environment favorable for bond income plays rather than relying on price gains. In other words, you don’t need bond prices to jump – you can lock in ~5–7% yields, which is an excellent income stream if the issuer stays solvent.

Additionally, if interest rates fall later in 2025, corporate bond prices could appreciate (just like government bonds). The extra yield cushion means even if rates stay flat, you still earn a strong return. Corporate bonds also benefit from a growing economy – as companies’ financial outlook improves, their bonds tend to strengthen and credit spreads (the extra yield above Treasuries) can tighten. Many analysts expect credit spreads to remain stable or tighten mildly in 2025 given moderate growth and easing inflation.

Risk and return profile: Corporate bonds carry credit risk – the chance the company could default or be downgraded. Investment-grade bonds (from large, stable companies) have very low default risk historically, only slightly higher than governments. High-yield bonds, on the other hand, behave more like stocks in terms of risk; they can fall in price significantly during recessions or if the issuer hits trouble. This is why high-yield debt offers such high yields – investors demand compensation for the risk of default.

In terms of volatility, investment-grade corporate bonds are only a bit more volatile than Treasuries, whereas high-yield bonds can swing more widely (though still usually less than stocks). In early 2025, corporate bond markets have been relatively calm, with investors willing to buy lower-rated debt thanks to the attractive yields. However, should the economy unexpectedly deteriorate, corporate bonds could face price declines, especially in the high-yield segment.

For return potential, let’s break it down:

- Investment-Grade Corps: Yield ~5% (on average). If rates drop, could see a few percent of price upside. Expected total return ~5–7% range for the year.

- High-Yield Corps: Yield ~7–8%. More sensitive to economic changes. If the economy stays on track, investors might also gain from price appreciation as credit spreads tighten. Potential total return could reach high single digits to low double digits, but with higher risk.

Notably, 2024 was a decent year for corporate bonds, with high-yield debt outperforming cash and Treasuries as investors sought income. That positive momentum could carry into 2025. Experts do caution to be selective – bonds of financially sound companies or those in resilient sectors (technology, healthcare, etc.) are preferable. Diversification via a corporate bond fund or ETF is a common approach to mitigate the risk of any one issuer.

Who it’s best suited for: Corporate bonds are a good fit for investors who want higher income than Treasuries but still less volatility than stocks. If you’re comfortable evaluating credit risk (or using funds managed by professionals), corporate bonds can play an important role in an intermediate or long-term portfolio. They’re often used by investors in their 40s-60s who are shifting somewhat out of equities into income assets, but still want better returns than plain Treasuries or CDs. High-yield bonds specifically may suit aggressive income investors or those allocating a small portion of a portfolio to boost yield – but these should be handled carefully, as they can drop in value in a downturn. A time horizon of 3-5+ years is wise, to give time for recovery if there’s any interim market stress.

- Risk: Low-Medium for investment-grade (minimal default risk; moderate interest rate risk), Medium-High for high-yield (notable default risk in downturns; behaves more like equity risk).

- Return Potential: Moderate – ~5% yield for high-grade, ~7–8% for junk bonds. Total returns in 2025 could be 6-10%+ assuming stable to improving economic conditions (income + some price gain).

- Best For: Investors seeking higher income and willing to take on a bit more risk than government bonds. Suitable for medium-term goals and income portfolios; high-yield bonds best for experienced investors or via a managed fund due to credit analysis needed.

4. U.S. Stocks (Large-Cap Equities)

Despite occasional volatility, stocks remain a cornerstone of growth-oriented portfolios – and 2025 looks promising for equities, especially U.S. large-cap stocks. The U.S. stock market has proven its resilience with strong corporate earnings and economic expansion. Many experts predict that U.S. equities will continue to perform well in 2025, though perhaps not without some bumps along the way. The consensus among analysts is for moderate to strong returns as earnings grow and valuations normalize.

Why it’s attractive now: The outlook for the U.S. economy in 2025 is cautiously optimistic. Goldman Sachs forecasts solid GDP growth of about 2.5% in the U.S. for 2025, outperforming many other regions. This economic strength feeds directly into corporate revenue and profits. In fact, Goldman’s equity research team projects the S&P 500 index will post its third-straight year of gains in 2025, rising roughly 9% in price (to around 6,500 on the index) which, with dividends, would deliver a 10% total return. They expect S&P 500 company earnings to increase about 11% in 2025, a healthy growth rate supported by both solid consumer demand and cooling inflation.

Several factors make U.S. large-cap stocks attractive:

- Earnings Momentum: Companies have adapted to higher costs and are still expanding margins in many sectors (tech, healthcare, etc.). Earnings growth in 2024 was robust and is set to continue in 2025.

- Tech and Innovation: The U.S. market is home to leading tech and AI companies that drove a large part of 2023’s rally. The secular trends (cloud computing, artificial intelligence, electric vehicles) provide tailwinds for many U.S. firms. This innovation edge is one reason Goldman’s team emphasizes “U.S. Preeminence” – they argue no major economy is catching up to the U.S. in key industries and market metrics.

- Potential Rate Cuts: If the Fed eases policy as expected, lower interest rates could boost stock valuations (since future earnings are more valuable when discounted at a lower rate). It also makes bonds slightly less competitive, possibly driving some investors back into equities.

- Global Uncertainty: Interestingly, the U.S. market is often seen as a relatively safe haven among equities. With geopolitical uncertainties and uneven recoveries abroad, global investors may continue favoring U.S. stocks, supporting prices.

All that said, experts do warn about valuations. After strong gains, the S&P 500’s valuation multiples are on the high side historically. At the start of 2025, the index traded around 21–22 times earnings, which is in the 90+th percentile of historical valuations. Such rich valuations could limit upside or lead to volatility if there’s any earnings disappointment. “High multiples increase the magnitude of downturns when there’s a negative shock,” notes Goldman strategist David Kostin. Therefore, while the base case is positive, investors should be prepared for possible corrections. Risk factors include: higher-than-expected interest rates (if inflation flares up), geopolitical events, or a significant economic slowdown that undercuts corporate profits.

Risk and return profile: U.S. stocks are higher risk, higher reward. They can experience double-digit swings in any given year. For example, in recent years we’ve seen the S&P 500 return +28% (2021), -18% (2022), and roughly +16% (2023) – a reminder of volatility. For 2025, forecasts cluster in the mid to high single digits, but with stocks one should always expect a range of outcomes. Over the long run, large-cap U.S. stocks have returned about 10% annually on average, making them one of the best wealth generators. Historically, holding stocks for at least 5 years greatly improves the chance of a positive outcome, as short-term downturns are overcome by growth.

The key risk to highlight is short-term volatility. A richly valued market could react sharply to any surprises (e.g. a policy shock or earnings miss). However, on the downside, a major earnings collapse or recession seems less likely in the near term given current projections. Stocks also face competition from high bond yields – in 2023-24, some investors rotated into bonds since they offered ~5% virtually risk-free. If bond yields remain high, stock valuations might stay somewhat restrained. Conversely, if bond yields fall, that could give stocks a further boost.

Who it’s best suited for: U.S. stocks are suitable for investors with a long-term horizon (5+ years) who seek growth. Intermediate-level investors typically hold a significant portion of their portfolio in equities to build wealth over time. Within U.S. stocks, one can invest broadly via an S&P 500 index fund or focus on sectors (like technology, finance, etc.) depending on preferences and risk tolerance. In 2025, experts aren’t necessarily picking a lot of niche sectors – broad large-caps are deemed as a group to be a solid bet, with particular strength expected in sectors like technology (riding the AI wave), consumer discretionary (if spending stays strong), and industrials (benefiting from infrastructure and reshoring trends).

For global investors, U.S. equities offer diversification and exposure to world-leading companies. They are best for those who can tolerate market ups and downs and who won’t need to liquidate the investment on short notice. Regularly investing (dollar-cost averaging) into stock funds can also smooth out the ride.

- Risk: High – Prices can be volatile; valuation risk is notable in 2025 (stocks are not cheap). However, lower risk than niche or emerging stock markets due to diversified blue-chip companies.

- Return Potential: High – Analysts like Goldman Sachs foresee around 10% total return for the S&P 500 in 2025. Long-term investors can expect ~7–10% annual returns from U.S. equities on average, though any single year can vary widely (could be -10% or +20% unpredictably).

- Best For: Growth-oriented investors with a long-term outlook. Suitable for building wealth for goals 5+ years out (retirement, education funding, etc.). Ideal for those who can handle moderate to high volatility in exchange for higher returns.

5. International & Emerging Market Stocks

Outside of the U.S., international equities – especially in emerging markets (EM) – present a compelling opportunity in 2025. These markets have lagged in recent years, but analysts see potential for a rebound driven by attractive valuations and improving economic prospects in key countries. Emerging market stocks include companies in developing economies across Asia, Latin America, Eastern Europe, and Africa, while international developed stocks cover markets like Europe and Japan. Here we focus on EM, as many experts specifically highlight the upside in emerging markets this year.

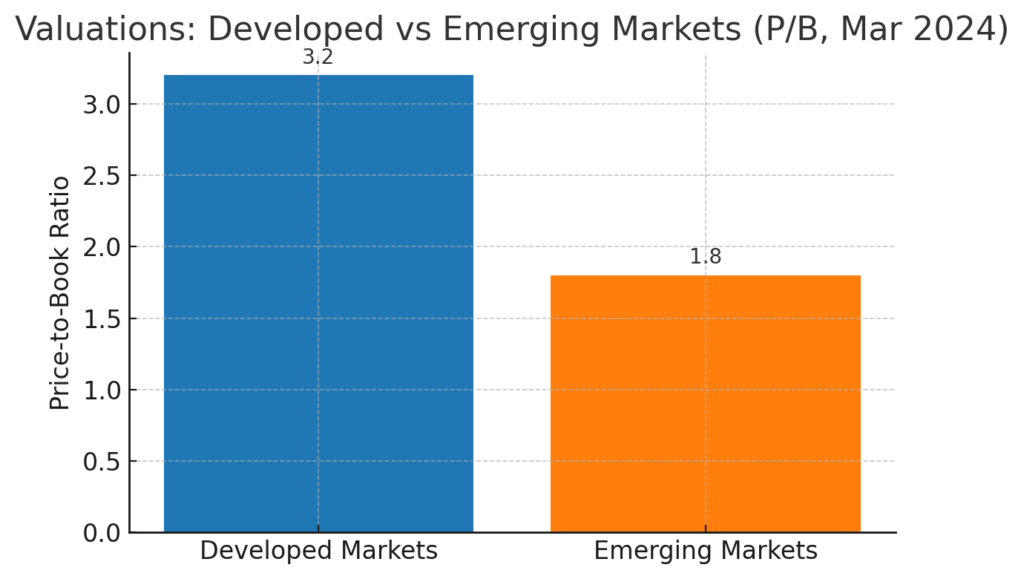

Why it’s attractive now: Valuations in emerging markets are notably cheap relative to U.S. stocks. According to Northern Trust analysis, emerging market equities are trading near their largest discount in decades. For example, the price-to-book ratio of the MSCI Emerging Markets Index is about 1.8, versus 3.2 for developed market stocks – roughly a 40% valuation discount (the norm was ~17% discount historically). This suggests a lot of pessimism is already priced in, and EM stocks may have more room to rise if conditions improve. (See chart below visualizing this valuation gap.)

Valuations: Developed vs. Emerging Markets (Price-to-Book Ratios as of Mar 2024). Emerging market stocks are trading at a steep discount to developed markets – a sign they may be undervalued.

Beyond cheap valuations, fundamentals are looking up in several major emerging economies:

- Economic Growth: Emerging Asia’s economies are projected to grow about 4.8% in 2025, far outpacing growth of ~1-2% in advanced economies. India, for instance, is forecast to expand a robust 6.5% in 2025, driven by resilient domestic demand. Higher growth can translate into stronger corporate earnings in those markets.

- China Recovery Hopes: China’s economy struggled in 2023 with property market issues, but late-2024 policy measures signaled support. Goldman Sachs analysts note China’s housing market may stabilize by late 2025 with over $1 trillion of stimulus in the pipeline. If China’s growth picks up (even modestly to 4–5%), that would lift sentiment for EM at large, given China’s weight.

- Commodity and Trade Trends: Many emerging markets (like Brazil, South Africa, Southeast Asia) are commodity exporters and benefit from steady or rising commodity prices. Others are manufacturing hubs that could gain from supply chain re-routing (as global companies diversify production). For example, countries like Vietnam, Mexico, and India are attracting foreign investment as alternatives to sole reliance on China.

- Earnings Growth: Equity analysts expect EM corporate earnings growth to outpace that of developed markets over the next 3-5 years. Northern Trust points out that in markets like Taiwan, India, and Korea, companies have significantly higher projected earnings growth than peers in the U.S. or Europe. Such earnings momentum, combined with low valuations, forms a recipe for potentially strong stock performance.

That said, international stocks are not without challenges. Europe and Japan have more moderate outlooks – Europe faces energy and geopolitical uncertainties, and Japan’s market, while doing better lately, depends on policy and global trade. However, diversification into these markets can still add value, and many global investors are underweight international after years of U.S. dominance. If the dollar were to weaken (possible if the Fed cuts rates faster than other central banks), that could further boost returns on non-U.S. assets for dollar-based investors.

Risk and return profile: Emerging market stocks are typically more volatile than U.S. stocks. They carry additional risks such as political instability, currency fluctuations, and sometimes lower liquidity. It’s not uncommon for EM indices to swing 30-40% in a year (either direction). For example, over the past decade EM stocks have underperformed, due in part to crises in countries like Turkey and Brazil, a slowdown in China, and a strong U.S. dollar. However, this underperformance is exactly why forward-looking experts see opportunity – the cycle may turn in favor of EM, as often happens after prolonged lags.

If things go well, EM stocks could deliver double-digit percentage gains in 2025. Even a partial mean-reversion in valuations could lead to outperformance versus U.S. stocks. For instance, if the valuation gap narrows, EM could rise faster. But risks include: a sharper slowdown in China, any resurgence of global trade tensions (the IMF warns that high tariffs or “de-globalization” moves would hurt Asia’s outlook), or a financial crisis in an EM country with high debt. Additionally, while a U.S. recession isn’t expected, if one did occur it could spill over to dampen EM growth.

International developed stocks (like Europe) have a bit lower volatility than EM, but they too have lagged. Europe’s valuations are also attractive, and if energy prices stay manageable and the war in Ukraine doesn’t escalate further, European markets could see moderate gains. Japan has been a surprise winner in 2023, and some believe its rally can continue as corporate reforms take hold and the central bank maintains an accommodative stance.

Overall, adding international exposure can improve diversification – EM stocks don’t always move in lockstep with U.S. stocks, so they can reduce portfolio risk when included appropriately.

Who it’s best suited for: International and EM stocks suit investors looking for diversification and willing to accept higher volatility for potentially higher returns. Intermediate investors often include a slice of EM in their equity allocation (e.g. 10-20% of equity exposure) to capture global growth opportunities. It’s best for those with a long horizon (5-10 years), as EM cycles can be prolonged. You might consider EM funds or ETFs to get broad exposure (covering dozens of countries and industries) rather than betting on a single country, unless you have expertise there.

This category is also good for value-oriented investors – it’s one of the few areas where valuations are clearly below historical averages. As Northern Trust’s report title suggested, it may be time to “seize the opportunity in emerging markets” given the combination of undervalued stocks and improving earnings outlook. Just be mentally prepared for a bumpier ride and do not overweight EM beyond what your risk tolerance allows.

- Risk: High – Higher volatility and numerous risk factors (economic, political, currency). EM stocks can have large drawdowns. Developed international stocks are moderate risk (a bit less volatile than EM, but more than U.S.).

- Return Potential: High – With low valuations and higher growth, EM equities could potentially return 10-15%+ in 2025, outperforming if conditions are favorable. (By contrast, developed international stocks may aim for, say, 5-10% returns if their economies improve). Over the long run, EM equities have strong return potential but require patience.

- Best For: Diversification seekers and investors with a long-term growth focus. Those who feel the U.S. market is expensive and want to buy growth at a reasonable price abroad. Suitable for investors who can handle significant volatility and are investing for 5+ year horizons (e.g., retirement savers adding an EM fund to their portfolio).

6. Real Estate (REITs and Real Estate Investment Trusts)

Real estate – particularly through Real Estate Investment Trusts (REITs) – is another asset class experts recommend for 2025. REITs are companies that own income-producing real estate (such as apartments, offices, shopping centers, warehouses, etc.) and are required to pay out most of their income as dividends. They offer a convenient way for investors to gain exposure to real estate without owning property directly. After a challenging period due to rising interest rates, the real estate sector may be poised for a rebound if rates stabilize or decline.

Why it’s attractive now: “REITs are cheap” – that’s the refrain from multiple analysts. By late 2024, U.S. REIT valuations had fallen to levels that looked attractive relative to both their own history and the broader stock market. A Morgan Stanley analysis highlighted that REITs were trading at a rare discount to the S&P 500 on an earnings multiple basis (i.e., REIT stock prices were low relative to their funds-from-operation, a measure of earnings). This was partly due to the surge in interest rates: because REITs are interest-rate sensitive, their prices dropped as yields on safer bonds rose (making REIT dividends less relatively attractive).

However, Morgan Stanley’s investment team now views the sector as being on the “precipice of a compelling change” – namely, the shift from a rate hiking cycle to a rate cutting cycle. Historically, REIT total returns have a strong negative correlation with interest rates. When interest rates (and bond yields) fall, REIT values tend to increase, as cheaper financing and lower cap rates boost real estate values. As central banks are expected to start easing (with the Fed likely cutting rates in the second half of 2024 into 2025), we could see a more accommodating environment for real estate. In fact, data shows that real estate often outperforms in the year after the Fed begins cutting rates, compared to many other sectors.

For example, one study found that on average since 1980, the real estate sector has delivered strong returns (~15%+) in the first year after a Fed rate cut cycle beginsmorganstanley.com. This makes intuitive sense: lower interest costs increase property values and REIT profit margins, and investors rotate into higher-yield sectors like REITs when bond yields drop.

Additionally, the underlying fundamentals in many real estate segments are solid:

- Residential and industrial properties have high occupancy and growing rents in many markets.

- Sectors like warehousing, data centers, and cell towers (which many REITs own) are benefitting from secular trends (e.g. e-commerce, cloud computing, 5G rollout).

- While office buildings face challenges due to remote work, most publicly traded REITs have limited exposure to the weakest office markets or have already been heavily discounted.

- Real estate also provides an inflation hedge – lease revenues and property values often rise with inflation over time, contributing to longer-term stability.

In 2024, REITs started to show signs of life – for instance, listed REITs in the U.S. had a very strong Q3 2024 (with nearly +17% returns that quarter) when the bond market rallied briefly. Although a late-year selloff trimmed some gains, it demonstrated the upside potential. Analysts at Morgan Stanley Investment Management concluded, “given that the Fed is expected to cut interest rates…we believe today is a great time to consider an allocation to REITs” (paraphrasing their outlook).

Risk and return profile: Real estate sits somewhere between stocks and bonds on the risk spectrum, but closer to stocks. REIT share prices can be volatile in the short term – they are publicly traded equities, after all. During the 2022 rate hikes, for example, U.S. REIT indexes fell over 20%. The risks for 2025 include: if interest rates unexpectedly rise further, that could pressure REIT prices again; also, if the economy weakens significantly, real estate demand (occupancy, rents) could falter. There are also sector-specific risks – e.g., the office sector’s troubles might deepen if remote work persists and leases roll off.

However, REITs typically pay high dividend yields (currently averaging ~4%+ for many REIT indexes), providing investors with substantial income while they wait for price appreciation. Those dividends can soften the impact of price swings. Over long periods, REITs have delivered returns comparable to stocks – often around 8-12% annually, counting both dividends and price gains. They have also outperformed general stocks in a number of past cycles, particularly when purchased at value prices.

For 2025, a realistic expectation might be: collect a ~4% dividend yield and potentially see mid to high single digit price appreciation, for a total return in the high single digits or low teens. If the rate-cut scenario plays out favorably, double-digit returns are on the table. It’s worth noting that not all real estate is equal – for example, residential/apartment REITs and industrial/logistics REITs are viewed more favorably than, say, retail mall REITs or office REITs. So, internal diversification or active selection can further manage risk.

Who it’s best suited for: Real estate investments are well-suited for investors seeking income and diversification. They often attract those in mid-to-late career or early retirement for the steady dividends. That said, younger investors can also benefit from REITs as a diversifier that doesn’t always move in perfect sync with other stocks or bonds. REITs tend to do well in moderate growth, falling rate environments – which is what 2025 is forecasted to be. They are also a way to invest in hard assets (properties) without the large capital or management burden of owning physical real estate.

For someone with a 3-5+ year horizon, adding REITs can provide a mix of growth and income. They can be accessed through REIT mutual funds, ETFs, or by buying individual REIT stocks. If buying individual REITs, it’s wise to focus on quality management and sectors with strong demand (like residential, industrial, tech-oriented real estate). Overall, if you’re looking for a balanced investment with say 4% yield and a chance for capital growth as interest rates ease, real estate fits the bill.

- Risk: Medium – REITs are equity-like in volatility; sensitive to interest rates and economic cycles. Some specific real estate sectors carry higher risk (e.g., office). Not risk-free, but less volatile than the most speculative stocks.

- Return Potential: Medium-High – Current dividend yields ~4% (providing baseline return). With even modest price recovery, total returns could reach ~8-12%+ in 2025. Historically competitive with stocks over long run, especially when bought after a downturn.

- Best For: Income-focused investors who also want growth, those seeking diversification via an alternative asset class. Good for a medium to long-term horizon (3+ years). Often used by investors balancing a portfolio (a mix of stocks, bonds, and some real estate). Ideal for those who believe interest rates will decline or stabilize, providing a tailwind for property values.

7. Gold and Precious Metals

Rounding out the list is gold, the classic safe-haven asset. Gold surged in late 2023 and early 2024, reminding investors of its value in times of uncertainty. Going into 2025, many experts maintain a bullish outlook on gold and other precious metals (like silver), citing factors such as geopolitical risk, central bank demand, and a potential peak in interest rates. While gold doesn’t produce income, its role as a store of value and hedge makes it a unique component in a diversified portfolio.

Why it’s attractive now: In volatile or uncertain markets, gold often shines – and indeed “gold is hot right now”, having climbed dramatically in the past year. By late 2024, gold prices repeatedly hit all-time highs above $2,000/oz. In fact, gold’s price was up nearly 40% year-over-year at one point, far exceeding what most analysts had expected. Driving this surge were multiple tailwinds:

- Market Volatility & Safe Haven Flows: Periodic stock market volatility and concerns (inflation, war in Europe, etc.) have driven investors toward gold as a defensive asset. Gold often gains when there is fear of recession or systemic risks.

- Central Bank Buying: Central banks around the world have been on a gold buying spree. They purchased record amounts of gold in 2022 and continued in 2023, and this trend persists. According to the World Gold Council, 2024 saw central banks adding to reserves at a pace not seen in decades. For example, Goldman Sachs noted that in December of last year, central bank gold demand hit 108 tonnes in a single month – far above historical averages. Central banks (particularly in China, India, Russia, and Turkey) are diversifying away from the U.S. dollar, and gold is a prime beneficiary. This consistent demand provides a firm underpinning for gold prices.

- Interest Rates Peaking: Gold typically moves inversely to real interest rates (interest rate minus inflation). In 2023, as inflation started cooling and the Fed paused rate hikes, real rates leveled off. Looking ahead, expected Fed rate cuts in 2025 lower the opportunity cost of holding gold (since gold yields nothing, it competes better when interest yields also fall). Goldman Sachs analysts anticipate that with the Fed likely to cut rates twice in 2025, gold will become more attractive relative to bonds. Declining yields often weaken the dollar as well, which further boosts dollar-priced gold.

- Geopolitical and Fiscal Concerns: Ongoing geopolitical tensions (e.g., uncertain U.S.-China relations, conflicts) and worries about high government debt levels have added to gold’s appeal as a hedge. If investors grow concerned about currency depreciation or fiscal instability, gold tends to be a refuge.

Risk and return profile: Gold is a peculiar asset – in some years it can soar (as we saw, +30-40%), and in others it can decline or languish. It doesn’t have an intrinsic yield or cash flow, so its price is driven purely by supply/demand and investor sentiment. This means gold can be volatile, but its volatility is often uncorrelated with stocks or bonds, which is why a small allocation can reduce overall portfolio risk.

For 2025, the outlook among many institutions is positive. Goldman Sachs, for instance, raised its gold price forecast, expecting prices to rise roughly another 8% from recent levels. They project gold could reach around $3,100 per ounce by the end of 2025 in their base case, and even outline scenarios where it could go as high as $3,300 if uncertainty remains elevated. Key drivers of such upside would be continued heavy central bank buying (they estimate that if central banks keep buying ~70 tonnes per month, gold could hit ~$3,200) and investors increasing their safe-haven allocation amid any crises. On the flip side, the main downside risk is if monetary policy stays tighter than expected – e.g., if the Fed doesn’t cut rates much, gold might only edge up to around $3,000 or slightly above by 2025, according to Goldman’s analysis.

Another risk to note: if the global economy is very strong and stock markets surge without hiccups, gold could see reduced interest as investors prefer risk assets. Gold also had a big run-up already; there may be some profit-taking or consolidation at high levels.

Who it’s best suited for: Gold is best for investors who want a hedge or diversification element in their portfolio. Intermediate investors might include a small allocation (e.g., 5% of portfolio) to hedge against tail risks like inflation spikes, financial crises, or geopolitical shocks. Gold is also appealing to those who are specifically worried about currency debasement or who want an asset not tied to any government’s promise.

It is not typically a yield-seeking or growth asset – think of it more as insurance. That said, at times like now, it can also offer competitive returns. It’s suited for virtually any time horizon, but you must be willing to tolerate its price swings and the fact that it doesn’t produce income. Gold can be held physically (coins, bars) or through financial instruments like gold ETFs, futures, or mining stocks. Many prefer ETFs or gold funds for convenience; others like physical gold for tangibility (though storage and insurance are considerations).

In 2025, if you anticipate macro uncertainty or simply want to balance out your stocks and bonds, gold fits the bill. Experts suggest it shouldn’t dominate your portfolio, but a small allocation can improve risk-adjusted returns. It’s particularly useful for those with a moderate or aggressive portfolio who want to add a defensive asset.

- Risk: Medium – Gold can be volatile and doesn’t always go up (e.g., it fell in 2015 and languished in the mid-2010s). No default risk (it’s a physical asset), but price risk is present. Also, it provides no income.

- Return Potential: Medium – After a huge run, further upside is expected but likely in the single-digit or low double-digit percentages over the next year. Analysts’ targets suggest maybe 8-10% upside in base case, with higher in bullish scenarios. Long-term, gold’s return roughly tracks inflation over centuries, but in shorter cycles it can outperform many assets.

- Best For: Investors seeking a hedge against volatility, inflation, or geopolitical risk. Suited for those who want an uncorrelated asset in their mix. Can be held long-term as a store of value. Typically a small portion of a diversified portfolio (e.g., 2-10% allocation).

Comparing Risk and Return of These Investments

Now that we’ve detailed each investment, it’s useful to see how they stack up against each other on a risk-return spectrum. Below is a comparative overview of all seven options:

| Investment | Risk Level | Expected 2025 Return (approx.) |

|---|---|---|

| Cash & Cash Equivalents | Very Low – Virtually no volatility or loss of principal. | ~4–5% yield. Stable interest income; no capital gain. |

| Government Bonds | Low – Low default risk; mild price fluctuation with rates. | ~4% yield. Potential total return 5–7% if rates falloaicite:71. |

| Corporate Bonds | Low-Medium (IG); Medium-High (High-yield) – Some credit risk. | ~5–8% yield. Total return 6–10%+ with interest + possible price uptick. |

| U.S. Stocks (Large-Cap) | High – Market volatility; economic/valuation sensitive. | ~10% (analysts’ forecast for S&P 500)oaicite:72. Could be higher or lower. |

| International/EM Stocks | High – EM very volatile; currency and political risks. | ~10%+ potential. (Undervalued, could outperform with ~10-15% gains if favorable). |

| Real Estate (REITs) | Medium – Equity-like volatility; rate sensitive. | ~8–12%. ~4% dividends + price rebound (historical avg. ~10%). |

| Gold & Precious Metals | Medium – Uncorrelated; can swing with sentiment. | ~5–10%. (Forecast ~$3,100/oz by end-2025oaicite:73, ~8% up from ~$2,850 baseline). |

Table: Risk vs. Return comparison of the 7 best investments in 2025. “Risk Level” is a qualitative assessment (from very low to high), and “Expected 2025 Return” indicates the rough annual return investors might anticipate for the year based on current yields or analyst forecasts. Actual outcomes will vary, but this illustrates the risk/return trade-off of each asset class.

As the table suggests, higher-risk assets (like stocks and emerging markets) generally offer higher return potential, whereas lower-risk assets (cash, bonds) offer more modest but stable returns. A balanced portfolio often contains a mix – for example, some cash for liquidity, bonds for income and stability, stocks for growth, real estate for income and inflation hedge, and a dash of gold for insurance. The “best” investment really depends on your financial goals, time horizon, and risk tolerance.

For 2025, experts are essentially saying: don’t put all your eggs in one basket. Each of these seven has a role to play:

- If you need safety or short-term access – lean on cash and Treasuries.

- If you seek income – high-grade and even some corporate bonds, plus dividend-rich REITs, are attractive.

- If you aim for growth – U.S. and international equities offer the highest upside, with emerging markets adding a value kick.

- If you want to hedge macro risks – gold is there as a backstop.

By combining these, investors can position themselves to weather a variety of market conditions. 2025 is expected to be a year of moderate growth, easing inflation, and transition in policy – a scenario where a diversified approach should pay off.

Conclusion

As we head through 2025, the investment landscape is both exciting and challenging. The seven investments highlighted – high-yield cash, government and corporate bonds, U.S. stocks, international stocks, real estate, and gold – each offer unique benefits that align with expert forecasts for the year. By considering your own objectives and the insights from financial analysts, you can craft a portfolio mix that balances risk and return.

Remember that even the “best” investments come with no guarantees. It’s wise to diversify across multiple assets to cushion against surprises. For instance, stocks may deliver strong returns but also swing with volatility – pairing them with some bonds or cash can mitigate downside. Likewise, assets like gold or real estate can provide alternative sources of return if equities underperform.

Finally, maintain a long-term perspective. While this report focuses on 2025, successful investing is a marathon, not a sprint. The recommendations by experts are meant to guide you based on current conditions, but staying flexible and reviewing your portfolio periodically is key. Markets can and will evolve. Use the information here as a starting point for deeper research or discussions with a financial advisor.

By staying informed and diversified, you’ll be well-positioned to navigate 2025 and beyond. Here’s to a year of wise investing and working towards your financial goals – with a portfolio that’s built for both opportunity and resilience.

Sources:

- Goldman Sachs Research – 2025 U.S. Equity Outlook (S&P 500 forecast)

- Goldman Sachs Research – Global Economic Outlook 2025 (GDP and policy forecasts)

- Reuters – IMF Asia Outlook (Emerging Asia & India growth projections)

- Northern Trust – Point of View: Emerging Markets (Valuation and earnings outlook)

- Morgan Stanley Investment Management – “A Compelling Opportunity in REITs” (Outlook for REITs with rate cuts)

- Morgan Stanley – Year of the Bond? (Stable 4–5% yields positive for bonds)

- Morningstar/BlackRock – Bond market commentary (“golden age” of bond investing)

- Goldman Sachs – Gold Outlook 2025 (Price forecast and central bank demand)